Current interest rate trends and future prospects

After recent periods of rising interest rates, real estate investors and owners are wondering how interest rates will evolve in the future. This is an opportunity to take a look at what the experts have to say, such as Christoph Sax, Chief Economist at VZ, who offers us an in-depth analysis of interest rate expectations for Switzerland, Europe and the USA.

Central bank intervention

Both the Swiss National Bank (SNB) and the US Federal Reserve (Fed) paused in their rate hike cycles, keeping them unchanged at their September meetings. The European Central Bank (ECB) has also done the same since October, reacting to the economic slowdown and falling inflation figures.

Central banks are taking a cautious approach, wishing to assess the impact of higher rates on the economy. Future direction will depend on developments in the labor market and inflation in the months ahead.

Swiss National Bank (SNB)

The SNB, which will make a new assessment on December 14, is likely to maintain its key rate at 1.75% according to market expectations. A possible cut is only envisaged from summer 2024, with stabilization at this level expected thereafter.

US Federal Reserve (Fed)

In the USA, interest rates are between 5.25% and 5.50%, and the market is expecting them to remain stable in the short term. Hopes of sharp rate cuts have diminished, as the Fed puts the fight against inflation at the forefront, even at the cost of high interest rates.

European Central Bank (ECB)

At its last meeting, the ECB decided against a further rate hike, believing that current rates are sufficient to contain inflation. Traders expect the key eurozone interest rate to remain unchanged until summer 2024, followed by a gradual cut if necessary.

Rate forecasts

Swiss government bond yields fell slightly in November, pushing down mortgage interest rates. The SNB, having maintained its key rate at 1.75%, could consider a cut by mid-2024, subject to inflation risks being averted. Mortgage rates have fallen significantly, with the ten-year fixed rate reaching 2.31% in December, the lowest rate since May 2022. Anticipation of a key rate cut in 2024 could lead to a slight fall in interest rates.

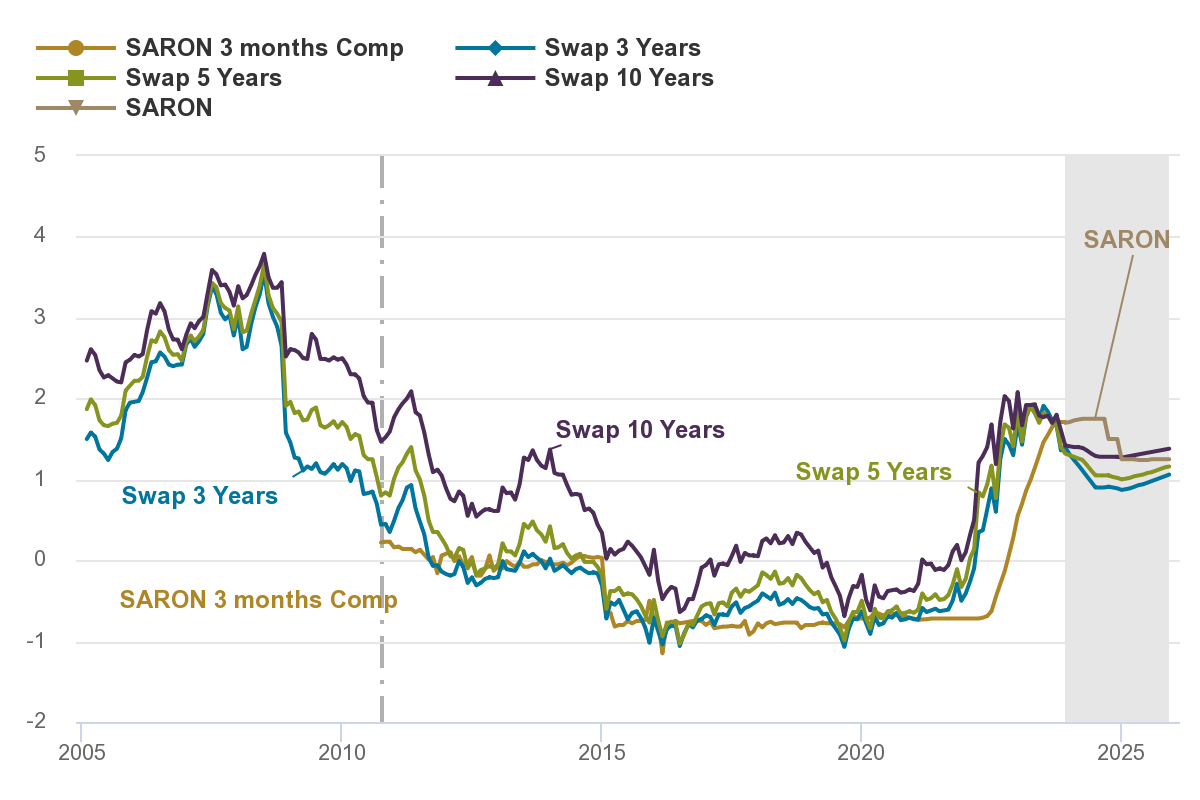

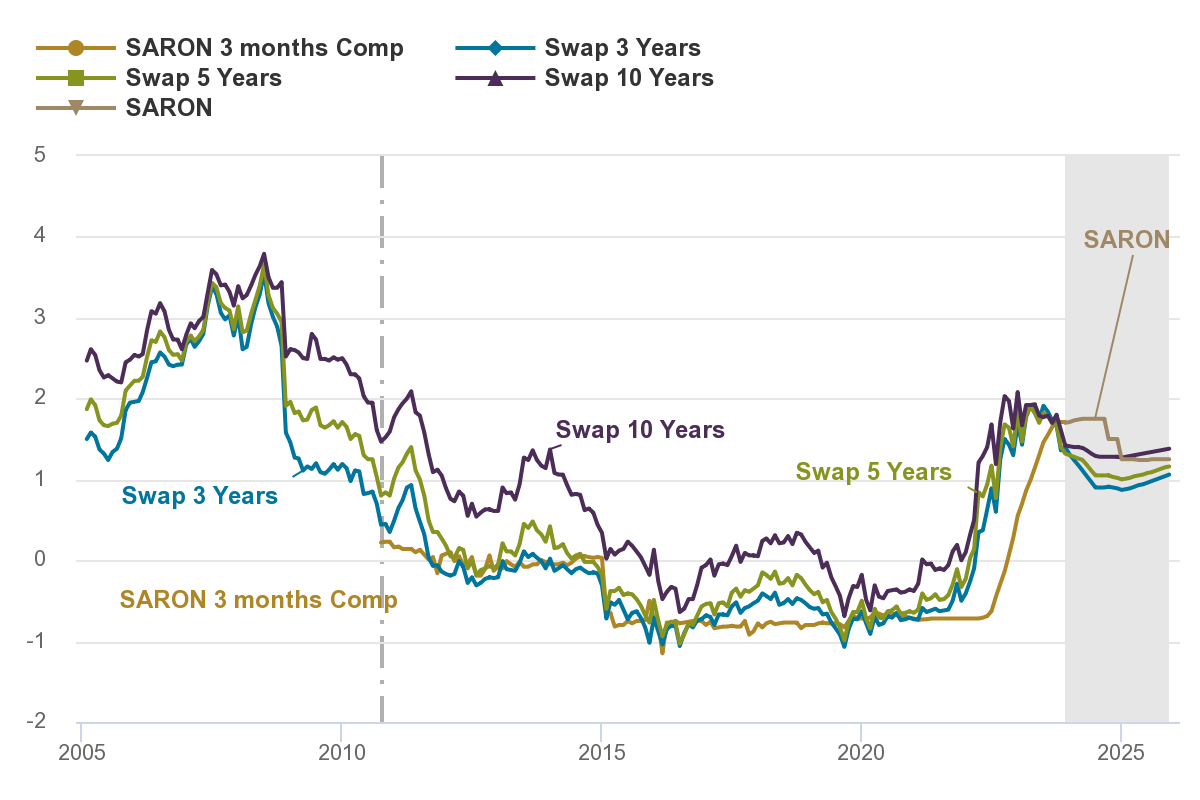

% change in rates - source : UBS - Interest rate forecast

Mortgage rates continue to fall

Mortgage rates are continuing the downward trend that began in June. The rate for a ten-year fixed mortgage is at its lowest since May 2022, at 2.31%. Two- and five-year rates are also down, to 2.26% and 2.19% respectively. This compares with 3.07% and 3.02% in mid-June 2022. This trend is the result of slowing inflation and the SNB's unchanged interest rate policy. Experts stress the importance of monitoring economic and inflation trends to anticipate future movements in mortgage rates, despite the expected short-term stability.

Conclusion

The financial markets have been over-optimistic on interest rate trends, and although the recent increases have not yet had their full effect, an economic slowdown seems imminent, albeit moderate. The outlook for interest rates varies by region, with downward trends more pronounced in Switzerland. The coming months will be crucial for monitoring economic signals and adjusting expectations accordingly.

Sources

Allnews - Article

VermögensZentrum - Article

UBS - Article

After recent periods of rising interest rates, real estate investors and owners are wondering how interest rates will evolve in the future. This is an opportunity to take a look at what the experts have to say, such as Christoph Sax, Chief Economist at VZ, who offers us an in-depth analysis of interest rate expectations for Switzerland, Europe and the USA.

Central bank intervention

Both the Swiss National Bank (SNB) and the US Federal Reserve (Fed) paused in their rate hike cycles, keeping them unchanged at their September meetings. The European Central Bank (ECB) has also done the same since October, reacting to the economic slowdown and falling inflation figures.

Central banks are taking a cautious approach, wishing to assess the impact of higher rates on the economy. Future direction will depend on developments in the labor market and inflation in the months ahead.

Swiss National Bank (SNB)

The SNB, which will make a new assessment on December 14, is likely to maintain its key rate at 1.75% according to market expectations. A possible cut is only envisaged from summer 2024, with stabilization at this level expected thereafter.

US Federal Reserve (Fed)

In the USA, interest rates are between 5.25% and 5.50%, and the market is expecting them to remain stable in the short term. Hopes of sharp rate cuts have diminished, as the Fed puts the fight against inflation at the forefront, even at the cost of high interest rates.

European Central Bank (ECB)

At its last meeting, the ECB decided against a further rate hike, believing that current rates are sufficient to contain inflation. Traders expect the key eurozone interest rate to remain unchanged until summer 2024, followed by a gradual cut if necessary.

Rate forecasts

Swiss government bond yields fell slightly in November, pushing down mortgage interest rates. The SNB, having maintained its key rate at 1.75%, could consider a cut by mid-2024, subject to inflation risks being averted. Mortgage rates have fallen significantly, with the ten-year fixed rate reaching 2.31% in December, the lowest rate since May 2022. Anticipation of a key rate cut in 2024 could lead to a slight fall in interest rates.

% change in rates - source : UBS - Interest rate forecast

Mortgage rates continue to fall

Mortgage rates are continuing the downward trend that began in June. The rate for a ten-year fixed mortgage is at its lowest since May 2022, at 2.31%. Two- and five-year rates are also down, to 2.26% and 2.19% respectively. This compares with 3.07% and 3.02% in mid-June 2022. This trend is the result of slowing inflation and the SNB's unchanged interest rate policy. Experts stress the importance of monitoring economic and inflation trends to anticipate future movements in mortgage rates, despite the expected short-term stability.

Conclusion

The financial markets have been over-optimistic on interest rate trends, and although the recent increases have not yet had their full effect, an economic slowdown seems imminent, albeit moderate. The outlook for interest rates varies by region, with downward trends more pronounced in Switzerland. The coming months will be crucial for monitoring economic signals and adjusting expectations accordingly.

Sources

Allnews - Article

VermögensZentrum - Article

UBS - Article